‘Search-urance’ – a brief guide to insure your Paid Search campaigns for the Auto Insurance Industry

Posted: Thursday, March 3rd, 2016 Posted by: Chirag DattaniWith Auto Insurance terms making the top of the list for some of the most expensive terms in Paid Search, this guide will help you refine your strategy and get more value from your paid search campaigns by reinvesting some of the Marketing $$ to areas which will yield better results. According to a 2015 study by AdGooroo, 5 out of the top 20 most expensive Paid Search terms include Auto Insurance terms which accounts for roughly $130 Million. That’s a high number with just 5 non-branded keywords.

Here are some best practices to refine your campaigns:

1) Mobile, Mobile and Mobile:

As Google recently announced that more than half the queries that are searched on Google, now comes from Mobile – this automatically makes it an important device to target. Especially within the Auto Insurance industry, a large % of Quotes/Policy Purchases still happens over the phone v/s Online so having a Mobile presence/optimized site is vital for the success of the program.

The on-the-go, in-the-moment nature of Mobile devices is quite different than desktop where providing users with relevant info at their fingertips, at the right time is the path to success. Few tips include:

- • Customer Service Number: With ever changing user behavior and different touch points on different devices that are involved in the Quote Process/Purchase path, provide users with both options – browsing the website and speaking to a live person. Especially for ads on Mobile, consider using both ‘Click to Call’ and an option to click and visit the website if the user chooses to do so. Often times, either the Mobile site is not optimized or still in the works – consider using at the very least the ‘Click to Call’ option so that users can speak to an agent and perform a desired action rather than giving away the spot to competitors.

- • Mobile Ad Copies/Bids: Create mobile specific ad copies and bid differently on Mobile to stay on top of competitors. Bids would likely differ depending on the capacity of the Call Center, Quality of the Calls and its Hours of operation.

- • Ad Extensions: Enhance your ads with use of all available/applicable ad extensions and gain visibility as well as acquire more real estate on the SERP. Popular extensions include: Sitelinks, Call Extension, Location Extension, Review Extension and CallOut Extension. If you have a Mobile app then consider driving app downloads through App Extension.

- • Dynamic Call Tracking: Measure the effectiveness of call conversions whether by using a third party call tracking software or AdWords call forwarding numbers and website call conversions. Dynamic call tracking is a powerful mechanism which will not only allow you to attribute the conversion and the conversion value back to the keyword/query searched and the ad that drove the customer to click but also provide wealth of information which can be used to optimize your campaigns. The dynamic nature of phone numbers also resonates well with other advertising channels and helps understand the true value of each channel.

2) Brand v/s NB:

Cost Per Click (CPC) tend to get very expensive especially within the Auto industry space for some of the generic Non-Brand terms like Auto Insurance or Car Insurance Quotes. To mitigate some of the cost, it is recommended to strategically segment your Brand traffic with Non-Brand and only advertise to highly targeted audience for NB terms in states/areas where it is profitable or has a positive ROI to achieve higher efficiency. Here’s how:

Brand:

In most cases, Brand traffic would be cheaper when compared to Non-Brand and it would likely bring in the most relevant traffic to the site by way of existing or new customers. With cheaper CPC’s/Cost and higher ROI, it is recommended to keep Brand campaigns fully funded, running nationwide if you are able to write policies in all states. On the other hand, if you would rather give that business away to your competitors due to profitability or other reasons then another option is to not advertise in specific states/zip codes/DMA’s where the impact would be minimum on Brand terms. Since you do not have control over what keywords competitors can bid on for their paid search ads, there is always a risk of losing traffic to competitors if you are not advertising across all states for your Brand terms.

Non-Brand:

Targeting for Non-Brand campaigns would likely have additional layers of complexity than just advertising nationwide. This however, also depends on a lot of different factors including Business Goals (Profitability or Brand Awareness), Loss Ratio, Cost Per Premium (CPP) or just bringing in maximum conversions/quotes across the country. Few things to consider:

- • Underwriting: Work with your underwriting team to understand and determine where there is room for improvement – often times this is not done frequently and we tend to go with the flow or simply put, everything remains as Status Quo. Challenging the Status Quo and going the extra mile will yield some great results – this has happened over and over again, even with some of the biggest brands in the market that one team is not in sync with another – for e.g., Underwriting and Marketing or Marketing and Legal. Asking the right questions to the right teams is important. There is always a reason why or why isn’t the team advertising in specific areas/states – understand what are those and why are they in place. ‘What if’ it was changed/updated/tested? Would it help achieve the business goals?

- • Target the Right Audience at the Right Time: Pick the right State/Zip/DMA/HHI/Age Group Level Targeting based on criteria that the business uses along with Business Goals – Loss Ratio, Cost Per Premium and so on. Display ads and modify bids during the peak hours of the day to stay in front of competition when it matters.

- • Re-Targeting: Build RLSA audience for Site Visitors, Abandoners, Policy Purchasers, Social Media etc. and retarget them with appropriate messaging as well as bid differently (likely more aggressive). If you advertise on Social Media like LinkedIn, Facebook and others by way of Custom Audiences then tagging those ads and building an audience off of that is a great strategy! For e.g., if you are targeting users who work at a specific list of companies on LinkedIn then LinkedIn will do the job of identifying users for you and once a user clicks on an ad, they will be captured in the RLSA audience and could be remarketed on Google.

3) Google Customer Match (Individual Level Targeting):

Google recently announced a new feature, Google Customer Match – something similar to Facebook and Twitter’s Custom Audience which allows you to use first party data and upload your existing customer email addresses on Google AdWords which can be matched to signed-in users and re-targeted on Google, YouTube and Gmail. Whether it be re-engaging with your existing customers, cross-selling different products, Brand Awareness or just having a consistent Brand messaging across all 3 platforms – Google, YouTube and GMail – Google Customer Match is a great tool to reach and stay connected with your most valuable customers.

4) Language Targeting:

Most advertisers use English as their campaign setting when they are targeting US – either nationally or specific states within US. This is a missed opportunity for the simple fact that the Hispanic population currently in the US – roughly about 54 million which likely has their browser language preference as Spanish are not interacting with the Brand. Having Spanish landing page, Keywords and Ad Copies is ideal to provide them with a great user experience. But if you don’t have the site built out in Spanish then you can at least open up the language setting to all languages to interact with the Hispanic audience and capture additional traffic/conversions. This strategy works really well in US because of the fact that even with preference of Spanish, majority of the users in US, speak/write in English so it isn’t the same as showing a Chinese ad to the English speaking user. This may not work internationally though where majority of users don’t speak English in a country like China or Japan.

5) Reporting/Data Visualization:

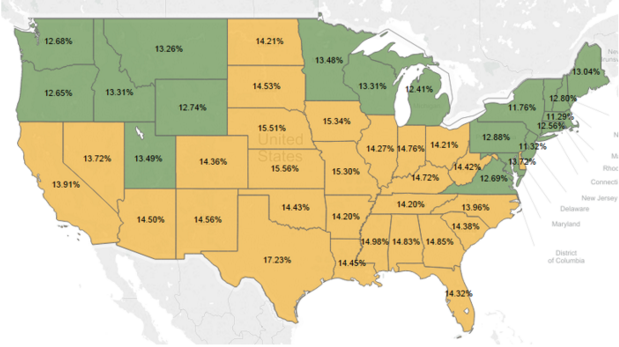

Who doesn’t like having easy to use/analyze data which helps in making some important business decisions? Since performance in Auto Industry varies drastically by states, it is important to understand data on a State Level instead of an aggregate level. Tableau has some great data visualization capabilities and in particular it allows you to plot data on a geographic region.

For e.g., you can easily plot data points on the map above including Cost, DWP generated, Cost per Lead and so on – all on a state level. This would allow you to adjust/move around invested $$ from low performing states by reinvesting them to high performing states.

In summary, use these tips as guidelines to better invest your Advertising $$, target the right audience and make appropriate adjustments to achieve killer performance.